Automobile insurance Terms and Glossary

No car insurance useful resource can be complete with out a comprehensive glossary of car insurance words. We've compiled some sort of list of terms and the definitions to better allow you to navigate the sometimes perplexing world of insurance coverage

Accident - This is an unexpected sudden celebration that causes home problems for an auto or bodily injury to a person. The big event may be an at-fault or perhaps not-at fault plus it may get report or unreported. A major accident involving a couple of vehicles may become termed an accident.

Accident report web form - This can be the record filed by law enforcement, often called law enforcement report, containing the top information regarding typically the vehicle collision. This report will include the names of all individuals involved, vehicles involved, property broken and citations which were issued.

Adjuster - This is the particular person who will certainly evaluate the actual loss reported on the policy following an accident or perhaps other incident. They will make the dedication how much may be paid on the auto insurance coverage policy by typically the Insurer.

Agent - This is a licensed and trained individual who is authorized to trade and to assistance coverage for the auto insurance organization.

At Fault : This can be a amount that you, the policy holder, contributed or caused the auto collision. This establishes which insurance company pays which portion of the failures.

Auto Insurance Rating - This will be a score identical to credit report that evaluates typically the information in the buyer credit report. These scores are used when determining costs for the auto insurance plan policy. Negative marks on your credit report can increase your own car insurance premiums. Typically the use of these details to determine insurance plan pricing does fluctuate from state in order to state.

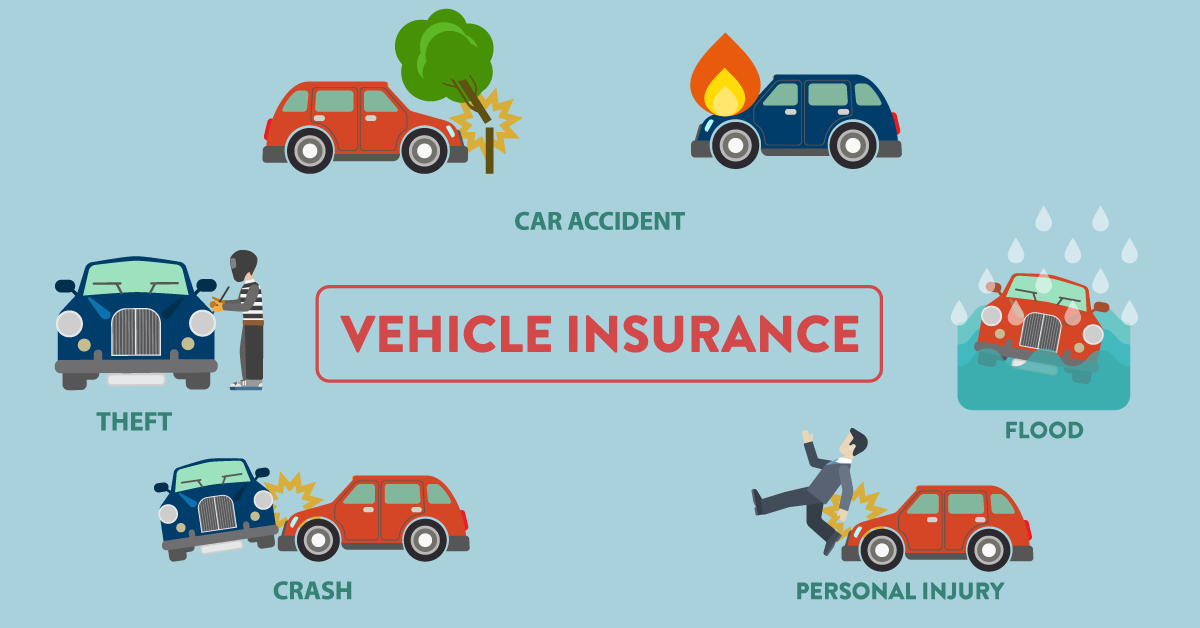

Automobile Insurance policy - This is definitely a type associated with insurance coverage that masks and protect in opposition to losses involving autos. Auto Insurance policies include an extensive range of coverage's depending on the policy holders requires. Liability for property damage and bodily injury, uninsured vehicle driver, medical payments, complete, and collision are some of the common coverage's offered under a good auto insurance plan.

Binding - This is a temporary short-term policy contract put in put while a basic permanent policy is put into location or delivered.

Body Injury Liability -- This is the section regarding an insurance policy that covers the particular cost to anybody you may hurt. It can consist of lost wages plus medical expenses.

Agent - This is definitely a licensed person that on your behalf sells and companies various insurance coverage.

State - This is an official notice made to your own insurance company which a loss has took place which may be covered within the phrases of the car insurance policy.

Promises Adjuster - This kind of person employed by simply the agency will investigate and negotiate all claims and losses. A agent for the insurance agency to verify and be sure all parties involved with the loss, get compensated fairly and correctly.

Crash - The portion of the insurance plan that covers destruction to your motor vehicle through hitting another object. Objects consist of but are not limited to; another vehicle, the building, curbs, guard rail, tree, cell phone pole or fence. A deductible may apply. Your insurance coverage company should go after the other events insurance policy intended for these cost have to they be responsible.

Commission - This can be a portion of the particular automobile insurance policy that is paid to be able to the insurance realtor for selling plus servicing the coverage on behalf of the company.

Comprehensive - This particular is a part of the insurance plan that covers loss caused by everything other than a new collision or working into another thing. A deductible will utilize. This includes but is definitely not limited to vandalism, storm destruction, fire, theft, and many others.

Covered loss instructions This can be a damage in order to yourself, others or property or if your motor vehicle that is protected under the automobile insurance policy.

Policy riders Page - This is the part of the insurance policy that includes typically the entire legal brand of your insurance carrier, your full legitimate name, complete vehicle information including vehicle identification numbers or perhaps VIN, policy info, policy number, allowable amounts. This site is often the front side page of the insurance coverage policy.

https://insurance.com - This is usually the area of typically the auto insurance plan that is typically the amount the insurance plan holder must pay out up front prior to the Insurance Company contributes and is needed to pay any benefits. This amount may be within an extensive range in price plus varies from about $100 - $1000. The larger amount you pay inside a deductible typically the lower your regular monthly/yearly policy will surely cost. This is the particular portion of typically the auto insurance insurance plan that might be applicable just to comprehensive or collision coverage.

Lower price - This is the decrease in the total price of your insurance policy policy. Deductions can be given for numerous sorts different reasons including a good driving report, grades, age, marriage status, specific features and safety gear on the automobile.

Urgent Road Service - This is the part involving an auto insurance coverage that covers the price tag on emergency services these kinds of as flat auto tires, keys locked inside the car in addition to towing services.

Recommendation - This is any written switch that may be made to be able to the auto insurance policy that is incorporating or removing protection on the plan.

Exclusion - This is the area of the auto Insurance coverage policy that consists of any provision which include people, places or perhaps things that are certainly not covered under the particular insurance plan.

First Get together - This is definitely the policyholder, the insured in the insurance plan.

Gap Insurance plan - This is a type associated with car insurance provided to people who lease or use an automobile that is worth less than the amount of the loan. Gap auto Insurance plan will take care of the quantity between the actual cash value of the vehicle and the sum left on mortgage should the proper care be stolen or even destroyed.

High-Risk Car owner - If a person have a variety of limiting marks on your insurance policy record including driving a vehicle under the Affects, several traffic violations, etc. you may well be defined as some sort of risk for the insurance company. This will improve your insurance plan or will make you ineligible for insurance.

Insured - The particular policyholder (s) which are covered by simply the policy rewards in the case of a reduction or accident.

Insurance firm - Is the Auto Insurance firm who promises to pay for the policy holder in the event of loss or perhaps accident.

Liability insurance coverage - This part of an automobile insurance plan policy which legally covers the destruction and injuries an individual cause to additional drivers and the cars when you are responsible in an accident. For anyone who is sued and taken up court docket, liability coverage will certainly apply to the legal costs that you incur. The majority of states requires individuals to carry a few variation of legal responsibility coverage Insurance plus this amount will be different state by state.

Limits - This can be the portion of the particular automobile insurance policy that explains and databases the monetary limitations the company may pay out. Found in the situation a person reach these restrictions the policy case will be in charge of all other expenditures.

Medical Payments Coverage - This is usually the portion of a car insurance coverage that pays for medical expenses and lost or damaged wages for you plus any passengers within your vehicle soon after an accident. It is also referred to as personal injury defense or PIP.

Motor unit Vehicle Report instructions The automobile record or MVR is a record given by the express when the policy owner resides for the reason that can list the guard licensing and training status, any visitors violations, various suspensions and. / or even refractions on your current record. This is one of the tools used within determining the superior prices offered by typically the insurance agency. This is also used to identify the probability of you having a claim on your coverage period.

No-Fault Insurance - In the event you live within an express with no-fault insurance policy laws and polices, your auto insurance plan pays for the injuries no subject who caused typically the accident. No-fault insurance states include; Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Mn, New Jersey, New york city, North Dakota, Missouri, Utah and Wa, DC..

Non-Renewal - This is the particular termination of a car insurance policy within the given expiration day. All coverage can cease as involving this date and insurer is going to be released of promised protection.

Personal Property The liability - This is the part of the particular auto insurance policy that covers any damage or reduction you cause to a new person's personal home.

Injury Protection or even PIP - This specific percentage of an vehicle insurance policy pays for any lost wages or medical charges to you plus any passengers inside your vehicle pursuing an accident. PIP is also recognized as medical repayments coverage.

Premium instructions This is typically the amount charged to be able to you monthly, annually or any some other duration agreed after by insurance company and policy holder and paid right to the particular auto insurance firm. A premium is definitely based on the sort and amount of coverage you choose for your vehicle(s) and yourself. Elements that will impact your insurance premium prices include the age, marital position, you're driving in addition to credit report, the sort of car you drive and whether you reside in an metropolitan or rural location. Premiums vary by simply insurance provider and the particular location you reside.

Estimate - This can be an amount or estimated volume the insurance will surely cost based on the information provided to be able to the agent, dealer or auto insurance plan company.

Rescission. -- This is actually the cancellation involving the insurance plan went out with back to it is effective date. This may result in typically the full premium that was charged being returned.

Rental Repayment - This is the percentage of the particular auto insurance coverage that covers to buy a automobile rental regarding similar size if the covered vehicle have repair from a new reported incident.

Replacement Cost - This is the sum of money it would cost to exchange a lost or perhaps damaged item from it really is new substitute value. This budgetary amount would get based on a new identical item in the present local market.

Save - This will be the auto insurance insurance plan holders property which is turned over tot eh insurance company in a loss last settlement. Insurance companies will sell the salvage property hoping to recoup a number of its monetary loss due to the loss and pay out.

Second Party instructions this is the particular actual insurance firm in the auto insurance policy.

Surcharge -- This is the particular amount added to your own auto insurance policy premium after some sort of traffic violation or perhaps an accident when you were found to get in fault.

Third Celebration - This is definitely another person besides the policy case and auto insurance policy company who may have faced a loss in addition to may be in a position to collect plus be compensated on behalf of the policy holder's negligence.

Total Loss - This will be complete destruction to be able to the insured home of a policy holder. That has been established that this would be a great sum of money to repair typically the item rather than replace the insured bit of property to the state prior to the loss.

Towing Coverage - This particular is the section of the vehicle insurance policy that will covers a specified amount for towing services and related labor costs.

Under insured Driver - This is the portion associated with an auto insurance coverage which covers injuries to you caused by simply a driver without enough insurance to pay out for the health care expenses you have suffered from the incident. This is portion of the policy can vary point out by state like a states include harm to the car found in this section.

Uninsured Driver or Motorist - This can be the portion of the automobile insurance policy which addresses injuries to an individual caused by a new driver who was without liability insurance plan at the time of the incident. Uninsured driver or even motorist coverage will come in two various sections; uninsured vehicle driver bodily injury and uninsured motorist property damage. Uninsured autos bodily injury insurance coverage covers the accidental injuries to you or even any passenger within your vehicle if you have an accident along with an uninsured drivers. Uninsured motorist property damage coverage masks the cost for your property damage in order to your vehicle when presently there is an incident with the identified uninsured driver. Uninsured car owner or motorist insurance must be offered any time you purchase the necessary liability coverage intended for your vehicle. You must sign a declination waiver in case you decline Uninsured driver or motorist insurance coverage. The majority associated with states require individuals to carry some kind of uninsured motorist insurance coverage. Some states incorporate damages to the car in this coverage.

Vehicle Identity Number or VIN - A VIN is a 18 letter and quantity combination that is the identification regarding the specific vehicle. It will recognize the make, device and year associated with the au